Regulatory Change Alerts : Stay informed with real-time updates on changing regulations.

Stay Ahead of Regulatory Changes with AI-Driven Compliance Solutions

Proactively Manage Compliance Risks and Ensure

Adherence to Regulations

Simplify Compliance with AI

Compliance is complex, but it doesn’t have to be. With our AI-driven compliance solutions, you can monitor regulatory changes, assess compliance risks, and manage audit trails seamlessly. Leverage GPT technology to stay compliant, reduce risks, and simplify audits, giving your business the confidence to thrive in a rapidly changing regulatory environment.

Key Features

Essential Features of AI-Driven Compliance

-

-

Compliance Risk Assessment : Identify potential risks and take proactive steps to mitigate them.

-

Audit Trail Management : Maintain and manage a digital record of all compliance-related activities.

-

Compliance Calendar : Get reminders for all statutory deadlines to avoid penalties.

-

Payroll Compliance : Ensure adherence to PF, ESI, and professional tax regulations.

-

TDS Compliance : Automate TDS calculations and return filing.

Benefits

Advantages of AI-Powered Compliance

-

Proactive Compliance Management : Address regulatory changes before they become a problem.

-

Reduced Risk of Non-Compliance : Mitigate penalties and legal risks with AI insights.

-

Simplified Audit Processes : Save time with automated audit preparation and tracking.

-

Efficiency in Operations : Focus on business growth while AI handles compliance.

-

Enhanced Transparency : Focus on business growth while AI handles compliance.

Compliance GPT FAQs

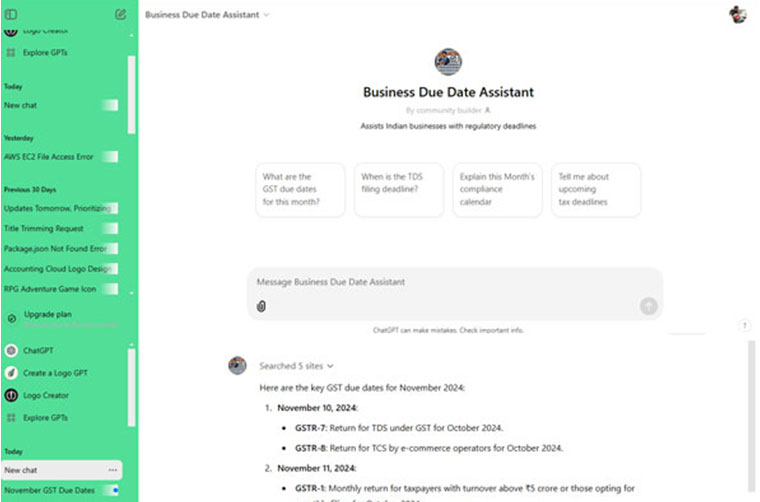

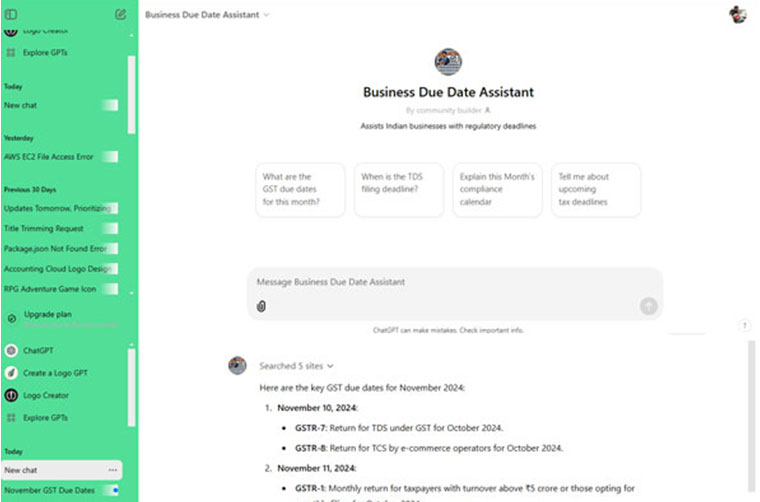

What types of compliance tasks can Compliance GPT handle?

Compliance GPT can manage payroll compliance (PF, ESI, PT), TDS filings, GST returns, and provide regulatory alerts.

How does Compliance GPT track regulatory changes?

It continuously monitors updates from government portals and regulatory bodies, providing real-time alerts.

Can Compliance GPT help with audits?

Yes, it streamlines audit preparation by automating the collation of compliance data and maintaining audit trails.

How does Compliance GPT reduce compliance risks?

By identifying gaps, providing proactive alerts, and ensuring timely submissions, it minimizes the risk of penalties and non-compliance.

Is Compliance GPT suitable for multi-location businesses?

Yes, Compliance GPT can handle compliance tasks across multiple locations, ensuring consistent adherence to regulations.

Ready to transform your financial operations?

Contact us today to schedule a consultation and discover

how our AI-powered solutions can benefit your business.